Oil prices are at the heart of drilling economics. They influence when, where, and how companies decide to drill for oil. Understanding the relationship between oil prices and drilling decisions helps explain why the industry can change so quickly.

What Are Oil Prices?

Oil prices represent the cost of a barrel of crude oil on the world market. These prices are tracked daily and can rise or fall based on many factors. For companies focused on drilling economics, even small changes in oil prices can have a big impact on their plans.

How Are Oil Prices Determined?

Oil prices are set by the balance between how much oil is available and how much people need. This balance is influenced by global production, storage levels, and trading activity. Drilling economics relies on these price signals to guide investment and operations.

What Factors Influence Oil Prices?

Understand oil price dynamics – EIA’s guide

Supply and Demand: The Foundation of Drilling Economics

The most basic driver of oil prices is supply and demand. When demand for oil is high and supply is tight, prices go up. If there’s too much oil on the market, prices drop. This simple rule is at the core of drilling economics.

Geopolitical Events and Their Economic Impact

Political events in oil-producing countries can disrupt supply and cause prices to spike. Wars, sanctions, or changes in government policy can all affect drilling economics by making oil either more scarce or more abundant.

Broader Economic Trends

The health of the global economy also shapes oil prices. When economies are growing, factories and cars use more oil, pushing prices higher. During slowdowns, demand falls and so do prices. Drilling economics must account for these cycles.

Technology’s Role in Drilling Economics

Advances in drilling technology can make it cheaper and easier to extract oil. When new methods lower costs, companies can profit even if oil prices are lower. This is a key part of modern drilling economics.

How Do Oil Prices Affect Drilling Decisions?

Profitability: The Bottom Line in Drilling Economics

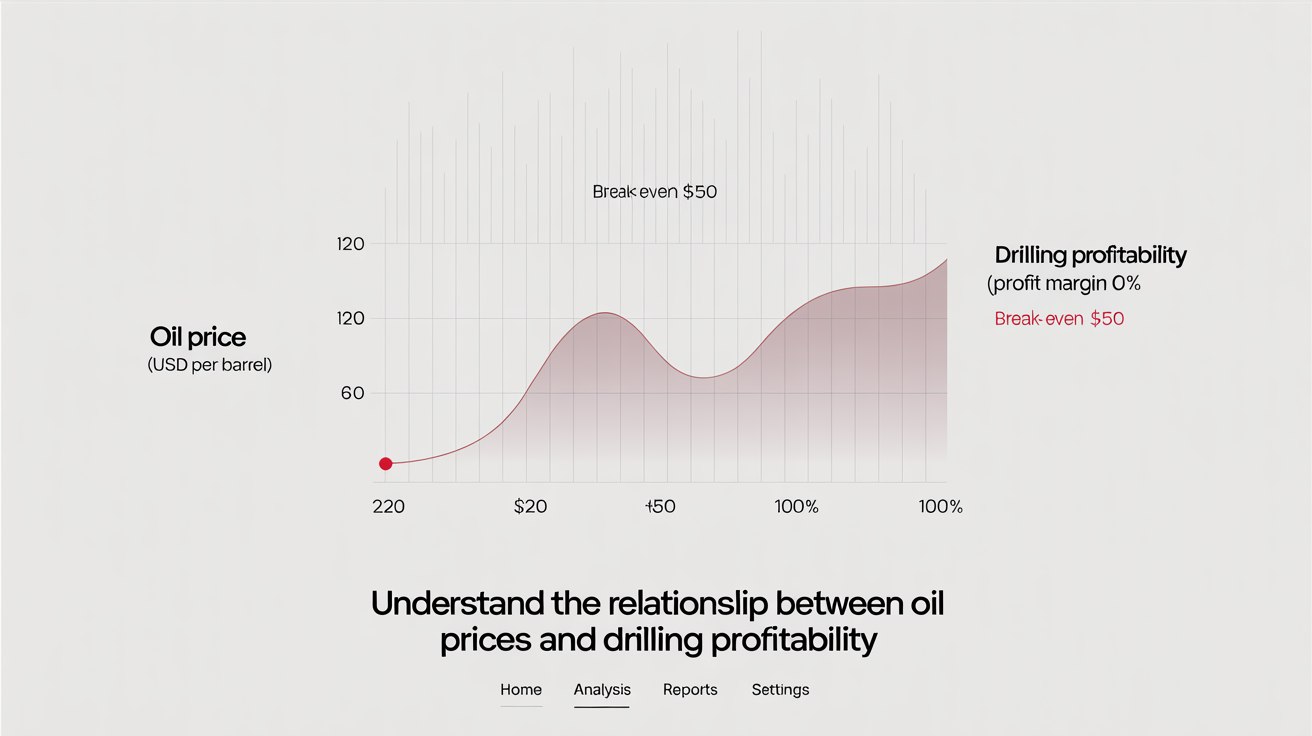

When oil prices are high, drilling is more profitable. Companies are more likely to invest in new wells and expand operations. If prices fall, many projects become too expensive to continue. Drilling economics is all about finding that balance.

Managing Production Costs

Every drilling project has costs, from equipment to labor. If these costs are higher than the price of oil, the project loses money. Smart drilling economics means keeping costs low enough to stay profitable, even when prices dip.

Investment Choices and Risk

Oil companies use price forecasts to decide where to invest. High prices encourage more exploration and drilling. When prices are uncertain, companies may delay or cancel projects. Drilling economics helps guide these tough decisions.

Exploration and Development Strategies

When oil prices are strong, companies look for new reserves and develop existing fields. If prices drop, exploration slows down. Drilling economics helps companies decide when to take risks and when to hold back.

Types of Drilling and Their Economic Impact

Conventional Drilling

This traditional method targets oil in easy-to-reach reservoirs. It’s often less expensive, making it a staple in drilling economics when prices are moderate.

Unconventional Drilling

Techniques like fracking allow access to oil trapped in shale or tight rock. These methods can be more costly, so they make sense only when oil prices are high enough to cover expenses.

Horizontal Drilling

By drilling sideways through rock layers, companies can reach more oil with fewer wells. This innovation has changed drilling economics by improving efficiency and reducing surface impact.

For a detailed overview of the equipment used in these processes, see our article on types of oil drilling rigs.

Planning for Price Fluctuations in Drilling Economics

Hedging Against Price Swings

Many oil companies use financial tools to lock in prices for their future production. This hedging helps stabilize income and manage risk, which is a smart move in drilling economics.

Diversifying Operations

Some companies invest in different regions or types of energy to reduce their exposure to oil price swings. Diversification is a key strategy in drilling economics for long-term stability.

Cutting Costs to Stay Competitive

When prices fall, companies look for ways to cut costs—streamlining operations, adopting new technology, or renegotiating contracts. These steps are essential for healthy drilling economics.

Consequences of Low Oil Prices in Drilling Economics

Job Losses and Industry Slowdowns

Low oil prices can lead to layoffs and reduced activity. Drilling economics shows that when projects aren’t profitable, companies must scale back.

Less Investment in New Projects

With less money coming in, companies may delay or cancel new drilling projects. This can affect future oil supply and the overall health of the industry.

Bankruptcies and Mergers

Prolonged low prices can force weaker companies out of business or lead to mergers. Drilling economics helps companies navigate these tough times and plan for recovery.

The Drill Down: Mastering the Economics of Oil

In the high-stakes world of oil and gas, understanding drilling economics is more than just an advantage—it’s a necessity. By staying informed, adapting to market changes, and making strategic decisions, companies like Norton Energy can navigate the ups and downs of the industry and continue to power our world.

Recent Comments